Designing Fair Personalization: Ethical Upsell Strategies for Third‑World Consumers

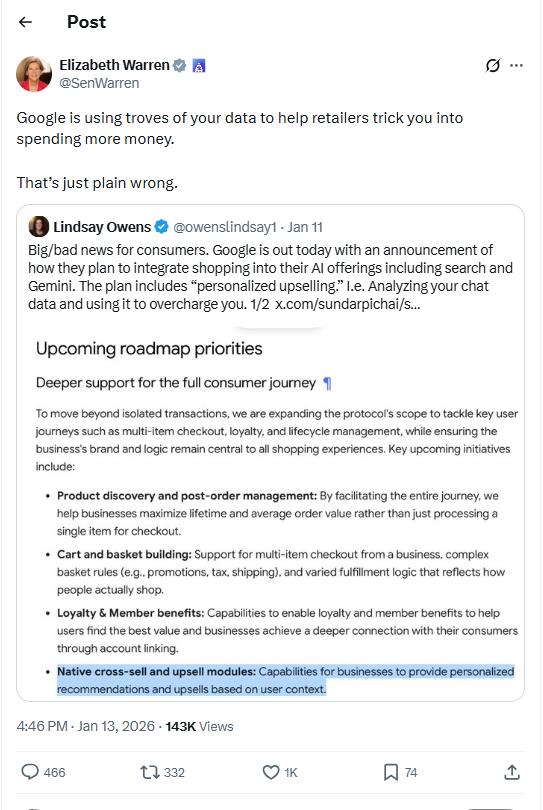

American Senator representing Massachusetts, Senator Elizabeth Warren’s recent exchange on X crystallizes a growing dilemma for technology and marketing leaders: how to harness personalization—and the revenue of targeted upsells—without turning economic inequality into an exploitation vector. For senior marketers, CTOs and founders operating in low- and middle-income countries (often referenced as "third‑world"), this is not an abstract regulatory debate; it is a product-design, data-governance and brand-risk problem with real human consequences.

Personalization is a scalpel: precisely applied, it reduces friction, surfaces value and deepens customer relationships; misapplied, it becomes a lever that widens gaps—extracting disproportionate revenue from the most vulnerable. Upsell strategies are similarly ambivalent: presented as tailored recommendations they can improve outcomes, but when driven by opaque algorithms and asymmetric information they mirror a bait-and-switch from which fragile economies suffer.

That conversation on X is useful because it forces three uncomfortable realities into focus. First, digital markets are global but sociopolitical contexts are local—what passes as an acceptable nudge in a high‑income market can be predatory elsewhere. Second, regulatory scrutiny is rising; goodwill and technical defensibility will not replace enforceable fairness. Third, ethical design is not merely compliance theatre: it is a differentiator that affects retention, reputation and long‑term monetization.

This introduction lays out a pragmatic framework: measure harms as well as conversion lifts, align price architecture with purchasing power, make intent and tradeoffs visible, and engineer for redress. The rest of this piece moves from philosophy to playbook—able to be implemented by marketing leaders, product architects and founders who must reconcile profitable personalization with basic fairness.

You will find concrete design patterns, governance checkpoints and measurement approaches that preserve lifetime value without monetizing need. This is not about moralizing diatribes; it is about designing systems that scale responsibly while protecting dignity and long-term brand equity in emerging markets —and building trust everywhere.

Executive summary & framing

A mother in Lagos borrows a neighbor’s feature phone to buy airtime and place a quick WhatsApp call to her daughter far away in the University. When prompted, she taps “yes” to a bundled offer; days later she disputes recurring charges she never intended. This vignette captures the stakes: personalized upsell can improve conversion, but it also risks unauthorized charges, erosion of trust and real hardship in emerging markets.

Sen. Warren’s consumer‑protection warnings about opaque billing and deceptive opt‑ins resonate here, even as industry pushes—like Google’s NRF 2026 emphasis on Universal Commerce Protocol (UCP), Gemini and native checkout—promise smoother, richer commerce across devices. The central thesis: the Agent Payments Protocol (AP2)/Agent2Agent (A2A) Protocol/Model Context Protocol (MCP) stack supplies the necessary technical primitives — authenticated payer intent, account-to-account settlement and multi‑party coordination — to block unauthorized charges. However, technical capability alone is insufficient. Safety rests on defaults, clear User Experience (UX) that surfaces intent, escrow and fast dispute resolution, and accountable governance that balances growth incentives with consumer protection.

Senior Marketers, CTOs and Founders should care because convenience-driven gains can be reversed by churn, chargebacks and reputational harm. The pragmatic tradeoff is clear: higher friction can reduce short‑term conversion but preserve lifetime value and trust. Implementers must choose sensible defaults (no prechecked bundles, affirmative consent flows), design visible price architecture aligned to local purchasing power, and bake in redress — escrow, instant refunds, and transparent dispute logs.

Think of the protocol stack like a well‑designed power grid: wires and transformers (AP2/A2A/MCP) deliver energy, but breakers, fuses and policy rules (defaults, UX, escrow, governance) are required to prevent fires. The following playbook turns these principles into actionable patterns, metrics and checkpoints you can apply today.

Security & privacy assessment of AP2 / A2A / MCP: strengths and operational gaps

Recap: AP2 carries purchase intent, cart state and payment mandates and exposes them as Verifiable Digital Credentials (VDCs) for compartmentalizing sensitive fields. A2A defines role‑based agent-to-agent communications and delegation semantics for automated actors. MCP standardizes intent/context interchange and metadata so AI models and orchestration layers can share intent, consent state, and sessions/events origin.

Strengths

- Verifiable intent: signed and encoded intent/mandate objects link user action to downstream execution.

- Tokenization: payment and identity tokens reduce exposure of raw credentials.

- Separation of duties: A2A role constructs limit which agents can act on mandates or modify cart state.

- Interoperability: MCP metadata schema enables consistent privacy, consent, and provenance fields across providers.

Prioritized failure modes & mitigations

1) Agent compromise — attacker uses delegated role to execute fraud. Mitigation: enforce least‑privilege roles, continuous attestation and behavioral anomaly detection; revoke tokens on anomaly.

2) Merchant collusion — backend bypasses consent, upsells hidden charges. Mitigation: mandatory signed receipts, client‑verifiable mandate hashes and independent escrow for funds pending reconciliation.

3) Long‑lived mandates — standing permissions abused over time. Mitigation: mandate TTLs and single‑use or purpose‑bound tokens with automatic expiry.

4) Weak key storage — keys exfiltrated from servers. Mitigation: hardware-backed keys (Hardware Security Modules, HSM, or secure enclave) and split‑key custody for high‑value operations.

5) Replay attacks — intercepted mandates replayed. Mitigation: nonce + timestamp + server‑side nonce tracking and short validity windows.

6) MCP context leakage — sensitive context propagated to nonauthorized models. Mitigation: privacy metadata tags, mandatory redaction policies and selective disclosure controls in MCP.

7) Ambiguous human‑present semantics — UX allows automated acceptance. Mitigation: mandatory explicit human‑friendly confirmation flows for purchases/upsells and standardized consent User Interface (UI) elements.

8) Dispute gaps — insufficient logs for adjudication. Mitigation: immutable, timestamped audit logs (append‑only), signed by participants, retained per policy.

Must‑have checklist for CTOs/auditors

- HSM/secure enclave key management

- Mandate lifecycle (Time To Live (TTL), single‑use, purpose binding)

- Signed, verifiable receipts and audit log retention

- MCP privacy metadata and selective disclosure controls

- Role‑based A2A attestation & revocation APIs

- Escrow/dispute integration and monitoring/alerting policies

Privacy‑first transaction flow (Shopify example — step‑by‑step)

1) Scoped search (MCP/A2A discovery)

- Primitive: MCP privacy tags + A2A discovery query (scope-limited).

- Security test: attempt to expand scope to retrieve unrelated merchant or Permanent Account Number (PAN) card data.

- User sees: "Searching for local sellers that match your preferences."

2) Local option presentation

- Primitive: Agent-side rendering of merchant offers with selective disclosure metadata.

- Security test: check that offer payloads exclude persistent identifiers.

- User sees: "3 nearby shops — prices shown without sharing your profile."

3) Explicit user approval

- Primitive: Human-present consent UI (signed consent token).

- Security test: simulate automated clicks; ensure consent requires biometric/PIN.

- User sees: "Approve this purchase? (requires PIN)"

4) Cart Mandate creation

- Primitive: Cart Mandate VDC (purpose-bound, TTL, single-use).

- Security test: replay mandate with different merchant ID — should fail.

- User sees: "Cart authorized for Merchant X — expires in 10 minutes."

5) Payment tokenization via wallet/payment agent

- Primitive: One-time payment token issued by wallet agent (no PAN exposure).

- Security test: attempt PAN extraction from token; validate token single-use.

- User sees: "Paying with your wallet — card details kept private."

6) Merchant validation

- Primitive: Merchant attestation check (Shopify merchant_id + signed attestation).

- Security test: present forged attestation; transaction should be rejected.

- User sees: "Merchant verified by Shopify."

7) Minimal fulfillment data exchange

- Primitive: Purpose-limited fulfillment envelope (name/address hash, delivery window).

- Security test: modify fulfillment envelope fields and confirm service rejection.

- User sees: "Only delivery address and contact allowed to fulfill your order."

8) Tamper‑evident logging

- Primitive: Append‑only signed audit log (participant signatures, timestamped).

- Security test: alter log entries — signature verification must fail.

- User sees: "Receipt recorded securely for dispute resolution."

9) Post‑transaction controls

- Primitive: Revocation & caps API (role-based A2A revoke, spend limits).

- Security test: revoke token after use; attempt reuse — should be denied.

- User sees: "You can revoke payment or set caps anytime in Settings."

UX & accessibility for low‑literacy, low‑bandwidth markets (Africa in focus)

Design for shared devices and intermittent networks by making consent and recourse immediate, visible, and language‑neutral:

- Image / audio‑first confirmation: show the product photo and play a short recorded summary in the user’s language before payment. For low literacy, use icons + a 3‑second audio clip that repeats order, price, and seller name.

- Hashed product artifact: bind a visible image + short hash (e.g., "Image ID: 4f2a9") into the payment mandate. Explain simply: the app stores the photo and a compact hash with the payment so the delivered item and the mandate can be matched later. This makes tampering detectable without showing complex cryptography.

- Confidence indicators: surface uncertainty numerically and plainly — e.g., "Agent is 78% confident this matches your order." This sets correct expectations for human agents or automated matches.

- One‑tap revoke & thresholds: place a single, prominent "Revoke" button on order screens for 24–48 hours. Tie high‑risk transactions to biometric/MFA thresholds (e.g., require fingerprint or One-Time Passwords (OTP) if payment > Naira X or if first merchant).

- Risk defaults: use Cash on Delivery (COD) or escrow for first‑time merchants automatically; show an escrow badge until funds release. Require photo‑on‑delivery attestation (buyer/agent takes a delivery photo that binds to the hash).

Low‑bandwidth fallbacks:

- SMS with image hash + one‑tap link to confirm or revoke.

- USSD numeric summary tied to a short PIN session for offline confirmation.

- Recorded audio confirmations delivered via call when data is unavailable.

UX copy examples (plain English):

- Purchase confirmation: "Buy TV from Kola for ₦45,000. Press Confirm to pay, or Revoke within 48 hrs."

- Escrow badge: "Funds in Escrow — released after delivery photo."

- Revocation button: "Revoke Payment (one‑tap)"

Field tests: recruit mixed literacy users (age, 30+), run task‑based sessions on shared devices and feature phones, use roleplay deliveries, measure comprehension, task completion, time, and error rates. Iterate with local moderators, test in low‑signal conditions, and include A/B of audio vs. visual prompts.

Governance, auditability and compliance checklist

Technical controls

- HSMs / device keys: Keys stored in Federal Information Processing Standards (FIPS)‑compliant HSMs or hardware device modules; key rotation and attestation must be available. Test: attempt key export or signing outside HSM — should fail; verify vendor attestation logs.

- Nonce/timestamp/replay protections: All sensitive operations require nonce+timestamp and server-side replay cache. Test: attempt replay should be rejected and logged with reason code.

- Single‑use tokenization: Payment and authorization tokens are single‑use and bound to merchant/session. Test: reuse token should be rejected and traceable to original session.

- MCP privacy metadata & redaction: Minimal Consumer Profile (MCP) metadata only; PII redaction on stored records. Test: automated extraction attempts return redacted fields; metadata contains only allowed attributes.

Operational controls

- Independent conformance testing: Provide conformance test report with passing cases. Test: run independent suite; failures must be tracked with remediation dates.

- Annual third‑party security audits: Publish scope and remediation history. Test: verify most recent audit report and closure of high/critical findings within SLA.

- PCI DSS (Payment Card Industry Data Security Standard) mapping for payment agents: Document PCI responsibilities and controls for each payment agent. Test: inspect mapping and confirm agents’ attestations.

UX / governance mandates

- Human‑present flags: Flows requiring in‑person confirmation set explicit flag. Test: attempt remote execution without flag — should be blocked and logged.

- Opt‑in for long‑lived permissions: Explicit opt‑in and simple revoke. Test: revoke button must cancel future permissions and generate confirmation.

- Clear personalization disclosures & field tests: Disclosures in local language(s) with audio option; run mixed‑literacy field tests (n≥30, shared devices & feature phones, roleplay deliveries). Acceptance: comprehension ≥80%, task completion and error rates within targets; iterate where below threshold.

Dispute / liability rules

- Escrow and refund flows: Funds held in escrow until delivery proof; defined refund SLA. Test: simulate delivery failure — escrow released per policy; refund issued and logged.

- Consumer access to signed transcripts: Consumers can request signed transcripts within SLA. Test: request returns signed, tamper‑evident transcript.

Public transparency disclosures: audit summaries and remediation, dispute and refund rates, conformance test results, key‑handling and HSM practices, and data‑redaction policies.

Metrics, vendor scoring and economic safeguards

Marketers and platform owners should measure fairness with a small set of operational and outcome metrics tied to incentives. Core metrics (beyond conversion): Trust Score (composite), complaint rate (complaints per 1,000 transactions), refund/return rate (refunds ÷ completed sales), mandate revocation rate (revoked mandates ÷ granted mandates), post‑purchase LTV (6–12 month revenue per buyer), and differential pricing audits (average price differentials controlled for product and region). Compute a Trust Score as a weighted composite of objective sub‑scores (see below), normalized 0–100. Tie incentives: make promotional eligibility, fee reductions, and visibility conditional on Trust Score bands; require remediation plans for vendors that fall below thresholds.

Vendor fairness score: dimensions and weights

- Privacy practices (20%): data minimization, consent, retention.

- Mandate semantics (15%): clarity and limits of upsell mandates.

- UX accessibility (15%): readability, language, assistive support.

- Escrow/dispute responsiveness (20%): SLA adherence, refund speed.

- Reputation/audit history (15%): past audits, complaint trends.

- Economic fairness (15%): price parity, transparent fees.Computation and example rubric

Computation and example rubric Each dimension is scored 0–100 via audits/logs.

Vendor Fairness Score = sum(weight_i * score_i) / 100Example:

- Privacy: 80 (20% * 80 = 16)

- Mandate: 70 (15% * 70 = 10.5)

- UX: 60 (15% * 60 = 9)

- Escrow: 90 (20% * 90 = 18)

- Reputation: 75 (15% * 75 = 11.25)

- Economic: 50 (15% * 50 = 7.5)

Total Score: 16 + 10.5 + 9 + 18 + 11.25 + 7.5 = 72.25

Policy Thresholds:

- ≥ 80: Full promotion and fee discounts.

- 60–79: Limited visibility; requires quarterly audits.

- < 60: Suspended pending remediation.

Stakeholder checklist

- Legal/regulatory brief signed; consumer helpdesk readiness; independent audit scheduled; public pilot transparency report prepared and published.

In markets where access is thin and trust is hard-earned, personalization must be measured, gentle, deliberative, and clear. Upsell not as extraction but as informed uplift and mutual value, offering relevance without the shadow of regret or exclusion.

Design with agency: simple choices, explicit consent, transparent cost, and algorithms audited continuously for bias, harm, and drift. Measure impact in livelihoods, not just click-through or short-term growth, and price fairness as a binding KPI that guides product roadmaps.

When founders, CTOs, and marketers choose restraint and clarity, they protect reputation, reduce churn, and cultivate enduring loyalty. The key impact is resilience: markets that grow inclusively and sustainably, sustained revenue from customers who trust, understand, and recommend.

Ethical upsell is not charity but smarter entrepreneurship alongside dignity, a future where profit and dignity move forward together, durable and humane built on metrics that honour people, not exploit them only for short-term gain.

Comments

Sign in to join the conversation

Sign In